Tax Extension Deadlines Are Coming Up in October and November

As fall sets in, it’s not just the leaves changing colors — tax extension deadlines are also on the horizon. While most people paid their taxes in April, both businesses and individuals have the option to apply for a tax extension, giving them around six more months to get their tax ducks in a row. While it might not be as exhilarating as Halloween festivities, staying on top of your tax obligations is essential if you want to dodge legal penalties.

What Is A Deadline Extension?

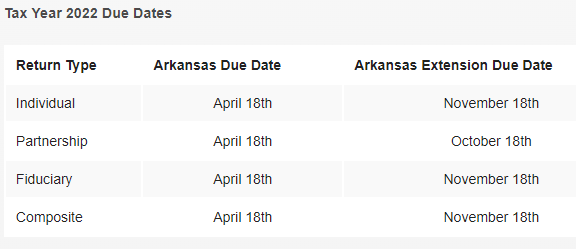

Deadline extensions apply to a variety of groups but focus mainly on individual taxpayers and businesses. In 2023, there are two deadlines: October 18 or November 18, depending on your type of return.

Partnerships have a payment deadline of October 18, while individuals, fiduciaries, and composites enjoy an extended payment deadline, which falls on November 18.

Different Types of Taxpayers

Partnerships are business entities where income and losses “pass” through to individual partners, who report them on their personal tax returns. The partnership itself doesn’t pay income tax but files an information return.

Individuals are regular taxpayers who report their personal income and deductions and then calculate their tax liability on their individual tax returns.

Fiduciaries are individuals or entities responsible for managing assets or property on behalf of others, like executors of estates or trustees of trusts. They file tax returns for the entities they oversee.

Composites are tax returns filed by partnerships or S corporations on behalf of non-resident members or shareholders. They allow non-residents to report and pay state income tax without filing separate individual returns in the state where the business operates.

Why Might You Need Legal Aid?

There are a few reasons you should consult with an attorney. For example, if your tax situation is complex — such as involving multiple income sources, investments, or business ownership — consulting with a tax attorney can help minimize your tax liability while ensuring compliance.

But there are other reasons you might want to consult with a professional.

If you are in dispute with the IRS or state tax authorities over the amount of taxes owed, are being audited, or have been accused of tax fraud or tax evasion, a tax attorney can negotiate with tax agencies on your behalf, challenge assessments, build a defense, and help resolve disputes through negotiation (if necessary).

Here are other reasons you might want to seek professional guidance:

- Estate and Inheritance Tax Issues: Consulting an estate planning attorney can help you create a tax-efficient estate plan and navigate the complexities of inheritance taxes if you’ve received an inheritance.

- State Tax Laws: State tax laws often differ from federal tax laws, and some states, including Arkansas, have their own filing deadlines and requirements.

- Tax-Related Litigation: If your tax situation has resulted in legal action, such as a lawsuit against the IRS or a dispute with a business partner over tax-related matters, a lawyer can represent you in court and help protect your rights.

- International Taxation: If you have international income or assets, the tax implications can be complex. An international tax attorney can assist with issues like foreign bank account reporting (FBAR), tax treaties, and compliance with international tax laws.

Hickey & Hull Law Partners Can Help You

While extensions give you breathing space to tackle those returns, don’t forget to meet those payment obligations promptly and steer clear of penalties.

But if you’re feeling a bit adrift or fear you have legal consequences due to non-payment, auditing, or other tax-related issues, don’t hesitate to reach out to Hickey & Hull Law Partners. Chat, fill out our online form, or contact us today to get a free consultation. Our River Valley office number is 479.434.2414, and our Northwest Arkansas number is 479.802.6560.